Can I repay my mortgage earlier? How does it work? Can the bank charge me for that? These are the questions that almost all of my client ask. And there is nothing surprising about it. Most of us would like to get rid of the mortgage as soon as possible. So in this post I would like to answer these questions.

You will also find out:

- how a loan transfer to another bank works

- how to buy or sell a house while in mortgage

The central character of this article is John. John is a Brit who has been living and working in Poland for several years. John bought an apartment in Wrocław for 445k. He had borrowed a mortgage loan of 400k for 25 years for this purpose.

John is a fictional character. From that moment on, John’s life and reality split into three different scenarios. In each of these scenarios, John is going to repay his mortgage before the term ends, but every time for a different reason.

But before I tell you about the alternative reality, let me give you some facts.

Prepayment of mortgage balance – how much does it cost?

Prepayment penalty (or an ‘exit fee’ or ‘early repayment charge / fee’) – an additional fee, specified in the mortgage loan agreement which will be charged by a bank for early (total or partial) repayment of the loan.

Under the Polish Act on Mortgage Loan and Supervision over Mortgage Brokers and Agents, banks are allowed to charge a fee for early repayment only:

- in the first 3 years of the loan repayment

- of up to 3%

Please note! According to the Mortgage Loan Act, the borrower can withdraw from the mortgage contract within 14 days of being paid out (or signing the contract) at no additional cost. You only have to return the amount paid out (if the loan has already been disbursed) by the bank and pay interest for these few days that have passed. Your bank cannot charge you then for early repayment.

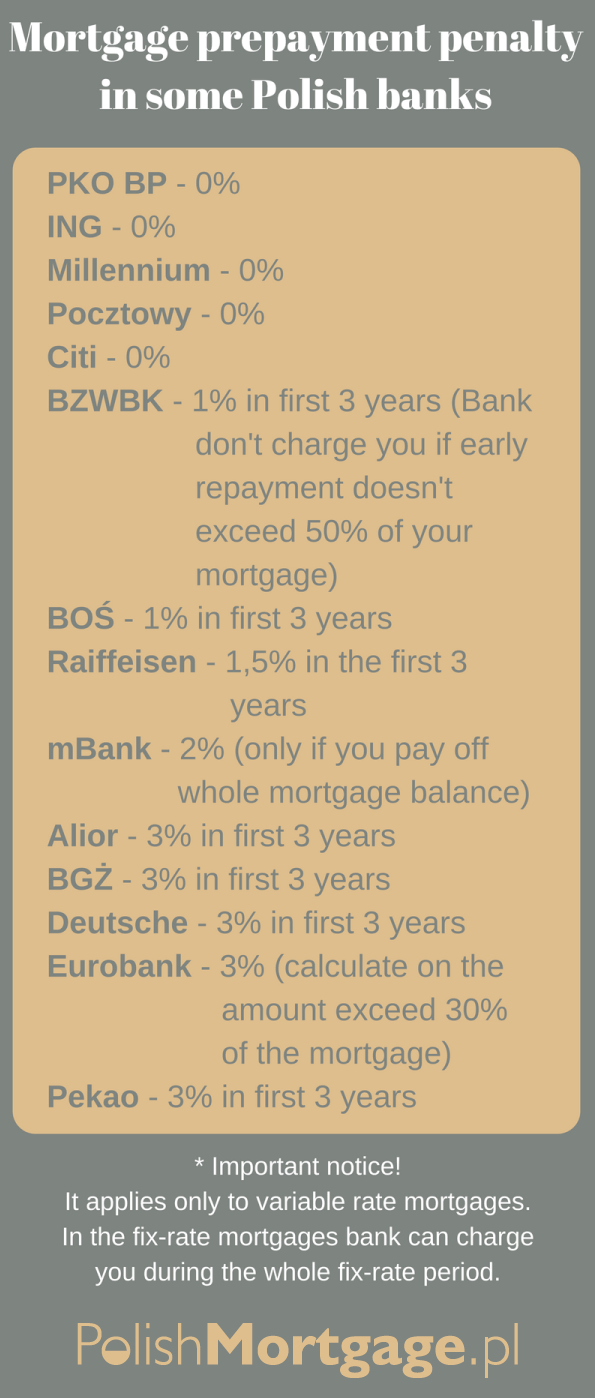

Prepayment penalties in Polish banks

Not all banks apply an early repayment fee to the maximum extent legally allowed and there are even banks that do not demand any fee at all.

Scenario No 1. John is leaving the country and wants to pay off his mortgage

It’s been 2 years since John bought the apartment. One day, John takes part in a LOTTO lottery and wins a prize of 5 million. This changes his life completely – he decides to move to Thailand permanently. The mortgage loan is to be repaid before the due date. He doesn’t sell the apartment in Wrocław – he decides to rent it out.

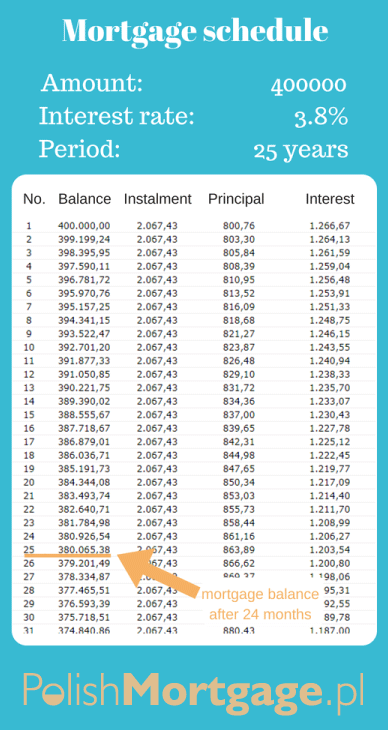

As you can see from the schedule, there is still 380k to be repaid. This means that John paid off 20k of his loan within two years.

It may seem like little, but this is the case for loans with an so called equal instalment and a long repayment period – in the first phase, we repay a relatively small part of the principal and we pay much in interest. This ratio changes with each successive instalment – the share of credit in it will grow, and the share of interest will decrease.

This means that 2 years after the disbursement of the loan there is 380k left, but let’s not forget about the prepayment penalty, which is 3% (unfortunately John’s bank has set in the contract the maximum amount of the exit fee allowed). The bank will make the following calculation: 380k +3% x 380k = 11,4k – this is the amount that the bank will debit from John’s account in order to repay the mortgage in full. In other words John needs 391,4k to pay off his mortgage.

You can also overpay the loan partially. You can do this repeatedly

Let’s assume that you want to overpay the loan in part in the first 3 years of the loan repayment and the bank applies a prepayment fee of 2%. If you want to pay extra 10k, for example, the bank will additionally charge 200 PLN (10k x 2%) prepayment penalty and debit 10200 PLN from your account. In the following month the bank will present a new repayment schedule with the loan amount reduced by 10k.

Transfer of a loan to another bank (remortgage)

You will also be able to repay the loan early if you transfer it to another bank. Yes, indeed, you can transfer your mortgage to some other bank.

Every bank in Poland offers a so-called refinance loan, i.e. a mortgage loan designed to repay the entire mortgage loan in another bank and to replace it in the mortgage register.

Why should you transfer your loan to another bank? The answer is simple – because you get a lower interest rate. These are the reasons why this may become possible after some time:

- You are more creditworthy and there are banks with a better offer available for you

It is possible that when you took out a mortgage the choice of available offers was limited because of your creditworthiness. After some time, your creditworthiness may improve (e.g. your income increase) and there will be offers from banks where you would have received bad ratings before

- Market has changed, banks lower the margins, better rates are available

This is perfectly possible. Currently, margins on the Polish market are higher than a few years ago. For example, in 2012 you could get a margin of 1.3 p. p. (10% down payment mortgage) and now a margin of more than 2 p.p. is what you get.

Perhaps in a few years’ time banks will lower their margins again and it will become profitable to transfer the loan to another bank. You may ask: in this case, would it not be easier to ask the original lender bank to reduce its margin on my loan? Probably even if your bank gives you a discount, it will be less than you can get by moving your loan to another bank and taking out a “new” loan.

If you want to know more about check out this article: Mortgage interest rates in Ponad – all you need to know

- You have paid off a portion of the loan, LTV is lower, better rates are available

LTV (Loan-to-Value) ratio tells us what is the ratio of a loan to the value of the property securing the loan. The lower the LTV, the lower the interest rate charged by banks.

More about LTV you’ll find here.

At the beginning, most borrowers usually can only make a minimal down payment (10% currently required in Poland). With the repayment of each subsequent monthly instalment, the loan shrinks, and consequently the LTV ratio also decreases. A reduction in the LTV below 80% may mean that banks offering a lower rate will be within your reach.

Such a situation is currently observed on the Polish market – with 20% of own contribution you will get a better offer than with the intitial 10%.

Another reason to change the bank may be that you are dissatisfied with the quality of service at your existing bank. A different bank may provide, for example, a better online service or better customer service in branches.

Scenario No 2. John wants to remortgage from Bank A to B

In this scenario, John doesn’t win the lottery and doesn’t go to Thailand. He continues to live and work in Wrocław. In 4 years he has repaid 10% of the original amount. This means that the encumbrance on the property (LTV) is no longer 90%, but 80% (assuming that the market value of the property has not changed) and this means that he can go to the banks that require 20% of down payment.

In this scenario, John doesn’t win the lottery and doesn’t go to Thailand. He continues to live and work in Wrocław. In 4 years he has repaid 10% of the original amount. This means that the encumbrance on the property (LTV) is no longer 90%, but 80% (assuming that the market value of the property has not changed) and this means that he can go to the banks that require 20% of down payment.

They require 20% of the own contribution, in which case they grant a loan in the maximum amount of 80% of the collateral value. The bank which will “take over” John’s mortgage will not require him to make any cash contribution.

John was presented with an offer by Bank B, which adds a credit margin of 1.4 p.p. (p.p. – percentage points). This is a big difference to 2.1 p.p. on the current loan. The 0.7 p.p. interest rate reduction means the lower instalment by 122 PLN and the lower total amount of interest in the remaining period of 21 years of repayment.

21 years? Yes, as John doesn’t want to extend the repayment period. The loan from Bank A has already been repaid for 4 years, it is 21 years left, so he applies to the Bank B for a “refinance” loan in the amount of 360k for a 21-year term.

It’s crucial that it’s been more than 3 years since the loan was taken out, so John won’t pay any exit fee for the early repayment. Bank B won’t charge any commission for granting a loan as well, which is very important because any initial fees would reduce the transaction profitability.

The procedure for applying for a refinance loan is the same as for a ‘standard’ home loan. John will need to provide all financial and real estate documentation. Bank B will check its creditworthiness, estimate the value of the property and decide whether or not to grant a loan.

John got approved for a loan by the Bank B and signs a new loan agreement. According to the contract, the condition for the loan disbursement is the delivery of a certificate from the Bank A containing the following information:

- details of the borrower (John), Bank A, and the loan agreement (start date, volume, repayment period)

- details of the collateral securing the loan

- total amount to be repaid + prepayment penalties when applicable

- account number to be used for full repayment

- statement that after the payment of the amount specified the bank will agree to the removal of the mortgage from the land and mortgage register

The Bank B will transfer the exact amount needed to liquidate the mortgage (pay off the mortgage) – in John’s case 360k. The court will then remove the Bank A from the land and mortgage register and enter the Bank B in its place.

From now on, John will be a customer of Bank B.

Is it possible to sell an apartment with a mortgage?

Of course you can! A large part of the real estate is purchased with the aid of a mortgage. If you want to buy an apartment on the secondary market it will very often turn out that the seller has taken a mortgage for the purchase. What’s more, the buyer can also credit the purchase. I will describe such a scenario below.

Scenario No 3: John meets Anna and wants to sell the apartment

In this scenario John doesn’t win the lottery either, but something even better happens to him – he finds the love of his life, Anna.

Together with Anna, they want to buy a house near Wrocław. John decides to sell his apartment and spend the money he earned from the sale on his contribution to the down payment on their dream home.

John’s apartment is in a good location so he quickly finds a buyer. The buyer – Mr. Tomasz – will also take out a loan to finance the purchase of the apartment.

John and Tomasz agree on the selling price of 450k. Tomasz will use 405k mortgage (45k he will pay down out of his own savings).

Four years have passed and there is still 360k to repay on John’s mortgage. How will such a transaction work? The same as with remortgage (transferring to another bank).

In the first place, John and Tomasz sign a preliminary agreement to buy and sell the apartment.

Tomasz pays 20k to John in the form of a deposit (this amount will be credited to the bank as part of down payment).

They agree on a 3-month deadline for signing a notarial deed, by which time Tomasz must sign a mortgage loan agreement.

After 2.5 months Tomasz informs John that he has signed a loan agreement with Bank C and they can go to a notary. Tomasz, as a buyer, brings a loan agreement. John brings the aforementioned certificate he received from his bank.

According to the certificate, 360k of John’s credit is payable. After signing the notarial deed Tomasz will transfer 25k to John’s account. (25k + 20k deposit that he transferred earlier will give a total of 45k – his own contribution).

Tomasz will bring the notarial deed and the certificate to his bank.

On the basis of these two documents, the bank will make two transfers:

- 360k – to John’s bank, to repay his loan, to the account specified in the certificate

- 45k – to John’s private account (450k – 20k – 25k – 360k = 45k)

In this way, John should receive a total of 450k (which was the selling price).

Once John’s loan has been settled, his bank will issue a permission to remove the mortgage from the land and mortgage register. The mortgage of Bank A will be erased and the mortgage in favour of Tomasz’s bank will be entered.

That’s it. I wish you to pay off your mortgage as soon as possible 🙂

I hope this article gave you an idea of the early repayment process. If you have any questions, feel free to write to me at: kamil@polishmortgage.pl

I also recommend you the following articles: Buying a flat on mortgage – let’s calculate initial expenses, 6 myths about getting a mortgage in Poland